Connecticut

Related: About this forumTax soda to level the field

Making America exceptional was, among other things, the decision made long ago to establish a federalist system of government, rather than a unitary system. Most of government is run by the states, not the feds. In France, for instance, the Ministry of National Education controls nearly everything French schoolchildren learn. In the U.S., however, the Department of Education has limited power, because local control was deemed critical to teaching American kids.

There’s a reason I’m noting this. It’s not to refresh your memory of a Civics 101 course you took ages ago. It’s to encourage all of us to think more broadly about taxation. In a conventional debate, we tend to think provincially — income tax, sales tax, property tax, etc. That’s understandable given most of the tax you and I pay goes to state and local governments. But how would feel about paying high taxes if you knew that some states have the luxury of keeping their taxes low on account of Connecticut and other states sending more than their fair share to the United States government?

Here’s another mind-bending question: What if there were a way for Connecticut to get some of that money back by — wait for it — taxing soda? I’m not a tax accountant, but it seems to me that our legislators have a chance to do that in the current session in the Connecticut General Assembly. It would be messy. It might be morally questionable. And there would be definite winners and losers. But in the end, by levying a penny-per-ounce tax on sugary drinks, we could end up taxing the United States government.

WalletHub is a personal finance website that released a survey last month ranking the states according to how many tax dollars they send to the federal government compared to how many they get. Connecticut, the survey found, ranked 42. We send more than we receive in the form of federal contracts, grants and other kinds of financial assistance. Kentucky is the most dependent on federal largesse while Delaware is the least. Florida is in the middle.

Read more: http://www.ctpost.com/business/article/John-Stoehr-Tax-soda-to-level-the-field-11073814.php

MichMan

(13,194 posts)Really confused how taxing Connecticut residents on soda somehow sticks it to other states ?

TexasTowelie

(116,799 posts)including those that receive food stamp benefits. By levying a tax on those benefits it is taxing a federal program which is how it sticks it to other states.

MichMan

(13,194 posts)So taxing poor people in Connecticut affects South Dakota in what way?

Buckeye_Democrat

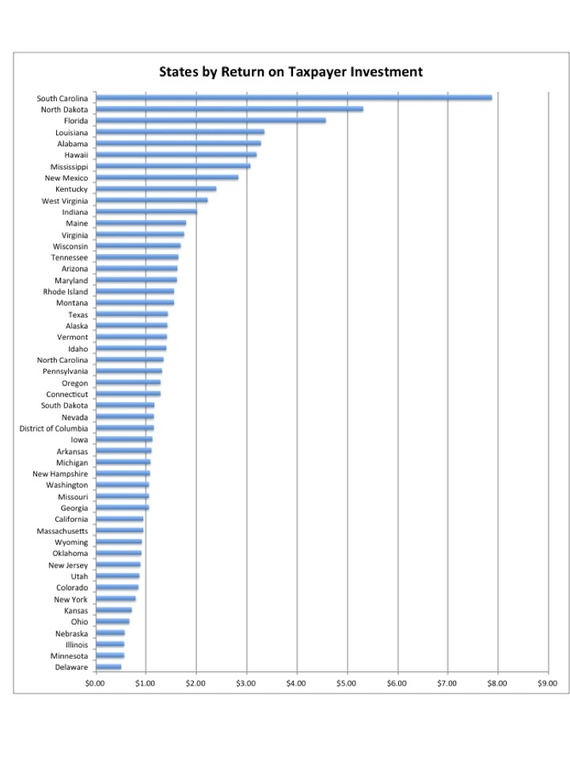

(15,042 posts)If you look only at the first measure—how much the federal government spends per person in each state compared with the amount its citizens pay in federal income taxes—other states stand out, particularly South Carolina: The Palmetto State receives $7.87 back from Washington for every $1 its citizens pay in federal tax. This bar chart, made from WalletHub's data, reveals the sharp discrepancies among states on that measure.

PoindexterOglethorpe

(26,727 posts)$.02/ounce on sugared soft drinks, the money thus collected be used to fund about one thousand additional pre-school students. The campaigning for and against is hot and heavy.

I have been contacted an amazing number of times, mainly by those who support the tax. Up to five times in one day. Despite Santa Fe's reputation for being place only rich people can live in, the reality is that most who live here, and especially those with young children, are not at all rich. The preschool for all is needed.

Those who oppose the tax see it as terribly regressive, will hurt the poor terribly, will cost jobs. Both Pepsi and Coca Cola have bottling plants here, although I have no idea how many they employ. Probably no more than a few dozen each, based simply on the fact that I drive by them often enough, and neither one has a huge parking lot. The other thing that has people terribly upset is the thought that people might start finding sugared soft drinks too expensive to buy, and will be forced to purchase other beverages. Or drink water, as if water meant some sort of poison.

Me? I don't drink sugared soft drinks more than two or three times a year, and so such a tax simply won't impact me.

And yeah, I'm going to vote for it. Not because I want to stick it to those who drink sugared soft drinks, but because I'm willing to support the pre-school education. Go ahead and tax something that I actually purchase, like fresh vegetables, and I'll still vote for that tax.