Study: Increasing Home Insurance Premiums By $500 Enough To Produce 20% Spike In Mortgage Delinquencies

When Miguel Zablah bought his five-bedroom home in Miami’s leafy Shenandoah neighborhood in June of 2020, he said he paid $7,000 a year for homeowner’s insurance. The house, built in 1923, sits on high ground and has survived a century of famously volatile South Florida weather. But in just four short years, Zablah said his homeowner’s insurance premium has more than doubled to $15,000 a year. Quotes for next year’s premiums are looking even worse.

“Some insurance companies are now quoting me at $20,000, $25,000 on my house, which is ridiculous,” said Zablah, who works in private equity. The premium increases are so steep that he’s considering just paying off his mortgage — and foregoing the insurance that his lender requires him to carry. “I’m very grateful that I'm in a good position,” he added.

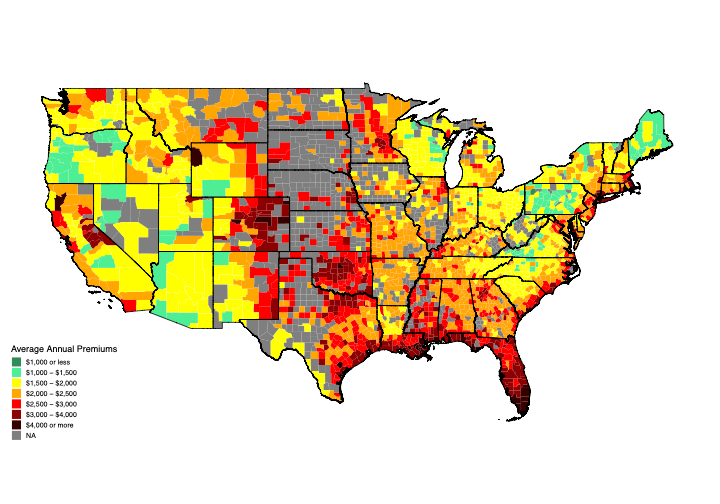

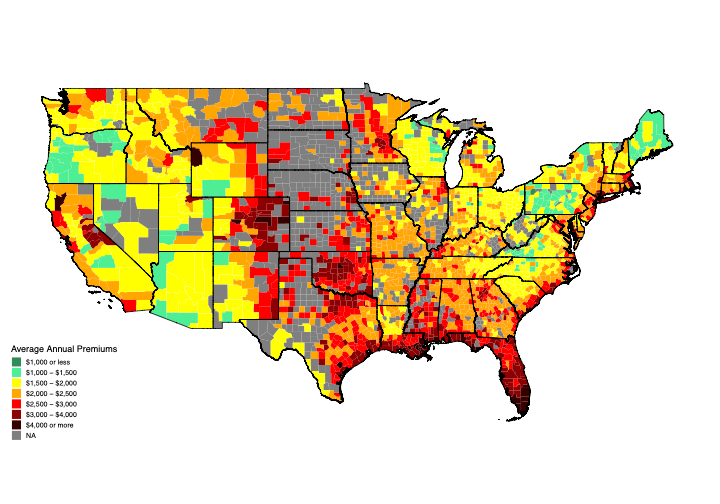

This map shows average annual insurance premiums by county in the first half of 2023. Source: Property Insurance and Disaster Risk: New Evidence from Mortgage Escrow Data,” June 2024, National Bureau of Economic Research

EDIT

Now, new research shows that higher insurance premiums like the one Zablah is paying significantly increase the probability of people falling behind on their mortgages — or motivate them to pay the debt off early. The outcomes spell trouble for banks, and for homeowners. How significant is the increase in mortgage trouble? A $500 spike in annual insurance premiums was linked to a 20% higher mortgage delinquency rate. That figure was extracted from findings in a recent study, which will be expanded and then undergo peer review, according to Shan Ge, an assistant professor of finance at New York University and one of the paper’s authors. “What we found, which is the first in the literature, is that as insurance premiums go up, we have seen an increase in delinquency of mortgages,” Ge said. The research adds to a growing body of scientific literature proving that the climate crisis is also a housing crisis.

EDIT

Zablah also heads the board of the Brickell Roads condominium association in Miami, where he owns an investment property. The effects of climate change are felt there too. Brickell Roads residents had been paying $350 a month in condo fees in 2022. But then Weston Insurance, the carrier of the association's windstorm policy, went bust. It was the fifth Florida insurance carrier to fold that year in the wake of Hurricane Ian, which slammed into the Southeast United States, causing an estimated $112 billion in damage. It was the most expensive storm ever in Florida and third most expensive in U.S. history.

As the association scrambled to find a replacement policy, it confronted a stark reality: monthly condo fees would more than triple under their new insurance policy. On Oct. 1, 2023, it raised the condo fee at Brickell Roads to $1,000 a month. (The board has since found another insurance carrier and hopes to lower the fee to $700 a month, according to Zablah.)

EDIT

https://floodlightnews.org/climate-change-drives-up-insurance-costs-and-missed-mortgage-payments/