General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsRec if you pay a higher effective tax rate than Mitt Romney

In the one tax return of his that we've seen, he paid 13.9%.

last year my effective rate was 23%.

I'm an Obama voter that gives a greater percentage of what I earn to the government than Mitt Romney does. He's more of a moocher than me.

I'm betting the overwhelming majority of people pay a higher effective rate than Mitt, especially when you consider payroll taxes like SS and Medicare that even the working poor pay.

seabeyond

(110,159 posts)and here we are all a part of the at lest.... 47%

i still believe harry. i think he said at loud what he has been told quietly and probably a damn good reason he said it out loud. harry is not careless.

tosh

(4,453 posts)This is a first for me.

I think I'll just hop on over to ActBlue and donate.

![]()

rsweets

(309 posts)porphyrian

(18,530 posts)spinbaby

(15,263 posts)Two working professionals in this household, working more than full-time hours. I'm not sure what our effective tax rate was last year, but it sure as hell was more than Mitt's.

brewens

(15,359 posts)somewhere that makes his actually lower than what he's shown. I'm just counting federal effective rate. You add in the payroll taxes and it's much higher.

ananda

(31,445 posts)I know it's at least 15%.

However.. it's the percentage in relation to income that counts.

14% of 250m is a lot different than 14% of much much much

much much less.

The problem with out tax system is the weight of the tax on

those with lower incomes, which is a much heavier burden than

the tax on those with higher incomes.

Jeff In Milwaukee

(13,992 posts)You've got a 7.65% tax rate (most years) from Social Security and Medicare alone. If you live in a city with municipal income taxes, you could be paying an additional 1-3% on top of that. And THEN you've got your federal and state income taxes.

So a lot of people are closer to paying 13% than they think. Remember, Mittens doesn't pay Social Security and Medicare taxes on his capital gains and dividends, and in many municipalities, income from these sources are exempt, as well. So you're miles ahead of Little Lord Fauntleroy right out of the gate.

nevergiveup

(4,815 posts)tolumnia

(22 posts)I do not know what my effective tax rate is, but it is surely higher than 14%.

SaveAmerica

(5,342 posts)SaveAmerica

(5,342 posts)TBF

(35,069 posts)a safety net. But do we really need more military than the rest of the world COMBINED? That is what makes me mad.

SaveAmerica

(5,342 posts)LittleGirl

(8,631 posts)ahg

(64 posts)OnionPatch

(6,271 posts)I've paid taxes every year of my adult life. Never voted once for a Republican and sure as hell won't be changing that trend anytime soon. (Probably not in my lifetime.)

spooky3

(37,280 posts)Jennicut

(25,415 posts)Mooching Rombot.

pnwmom

(109,801 posts)tweeternik

(255 posts).6% of Rmoney's!! Taking some of the discretionary income I have left and donating it to President Obama's reelection effort!!

mainstreetonce

(4,178 posts)Of the rate Mitt pays.

yardwork

(66,055 posts)lumberjack_jeff

(33,224 posts)hamsterjill

(15,736 posts)And I also know of several people personally who have net worths of at least $5 million, and they each paid a lower percentage of tax than I did in 2011. Capital gains, etc.

I'm sick of the inequity! I'm even more sick of the Republicans that I know who are in the same boat that *I* am in, and yet think it's okay that the super rich don't pay their fair share.

Shrike47

(6,913 posts)Lunabelle

(454 posts)You bet I pay a higher rate than Rmoney.

Bucky

(55,334 posts)Yoyu should be doing well enough afford a high rate.

LibDemAlways

(15,139 posts)payroll and property taxes and I'm at about 35. And I'm trying to put a child through the public university here in CA to the tune of almost 20K a year alone in tuition and fees - never mind living expenses. This after my husband took a 40% cut in pay after he was laid off when the Bush economy tanked and he was desperate for a job - any job.

My elderly mother gets by on SS and a tiny pension. True she pays no income tax because she has no income to be taxed. However, she pays property and sales taxes (8.25 in this county) every day.

There is not one person in this country who does not pay taxes, and for a wealthy tax dodger like Rmoney

to claim otherwise in an effort to stoke the fires of class division is dishonest and cynical beyond belief.

Z_California

(650 posts)My family paid no federal income tax last year because of our income level.

Since I am self-employed, I pay about 15% self-employment tax (both sides of Ss/Medicare). Between that and sales taxes, property taxes, and gasoline taxes I had an effective rate of about 18%.

I wonder how many of Rmoney's 47% are retirees who paid into the SS/Medicare system their whole careers?

EnviroBat

(5,290 posts)And this asshole is paying 20% less than me, (if he's paying anything at all)...

librechik

(30,818 posts)And that is the crime.

abelenkpe

(9,933 posts)Response to scheming daemons (Original post)

bupkus This message was self-deleted by its author.

TBF

(35,069 posts)still sorting out 2011 but will file by 10/15 as required.

joeglow3

(6,228 posts)I though my wife and I (with three kids) were doing great with taxable income of $120,000. However, our effective rate was less than 10%. I was surprised with many of the numbers - 15%, 20%, 24% and even someone at 31%. In crunching those numbers, assuming NO dependents and no deductions more than the standard deduction, these people are making:

In single:

15% - 123,000

20% - 190,000

24% - 275,000

31% - 800,000

If married:

15% - 230,000

20% - 320,000

24% - 450,000

31% - 1,200,000

I HAVE to assume people are confusing "marginal" with "effective."

TBF

(35,069 posts)I took the effective rate off turbo tax (there's a summary page that gives it to you). We don't make 320,000 but we are in the 6 figures so I'm not sure how you are "crunching" those numbers.

SickOfTheOnePct

(7,671 posts)Effective rate is taxes paid divided by AGI, not divided by taxable income.

joshcryer

(62,515 posts)I got mine from here: http://en.wikipedia.org/wiki/Rate_schedule_(federal_income_tax)

mountain grammy

(27,648 posts)But I paid plenty when I worked.. certainly a higher percentage than Rmoney. Oh, right, I paid payroll tax too.. what the capital gains tax scam steals from us. If you paid taxes, Rmoney, show us!!

mwooldri

(10,603 posts)What taxes to include? If it is just federal income tax, then our family is 7.5%. State income tax only is 4.9%.

If you look at things such as SS and Medicare contributions as well then I estimate at least 17% is my effective tax on earned income in 2011.

Of course this rate will go up when our children turn 18...

former9thward

(33,424 posts)People are posting so-called effective rates but are not posting what their income is. If they posted their income doing the basic math and the irs tax rates and standard deductions would be pretty easy. Some people are also throwing everything in with state, property, gas, etc taxes and calling it their "effective' rate.

jeff47

(26,549 posts)When we're talking about "taxes".

If Mitt said "federal income taxes", then you'd have a point. But he just said "taxes".

former9thward

(33,424 posts)Compare apples with apples not with oranges, pears and dates.

jeff47

(26,549 posts)"Payroll taxes" aren't collected from his paycheck, because he doesn't have one. Instead, they're collected on his income taxes.

I expect sales, property and gas taxes wouldn't move that number up much.

Which leaves state taxes. And since Mitt hasn't bothered to release them, I think assuming 0% is fair.

former9thward

(33,424 posts)If someone is paying 13.9% on the federal level they can't pay 0% at the state level.

harmonicon

(12,008 posts)He left it incredibly vague on purpose - I'm guessing it's almost entirely capital gains.

former9thward

(33,424 posts)He released the return. He paid 3 million on 21.6 in adjusted gross income. http://www.mittromney.com/learn/mitt/tax-return/2010/wmr-adr-return

jeff47

(26,549 posts)Tennessee, Texas, Washington and Wyoming.

They have no state personal income tax. But you know that, right? After all, you are claiming to be an expert in state taxes.

Now, MA has a state income tax of 5.3% on most income and Mitt claims he lives there. Are you now going to claim 5.3% makes a MASSIVE difference?

Or are you assuming that all state income taxes use tax brackets like federal income taxes? Perhaps there's some super-secret 120% rate for people who make as much as Mitt that would suddenly make state income taxes a relevant defense for Mitt?

We could figure out what Mitt's MA income tax rate is but he won't release his returns. So why give him the benefit of the doubt?

former9thward

(33,424 posts)Please post where I did that or retract your attempt to BS. BTW those states you mention (which are not relevant to this discussion, but you know that, have other taxes for their revenue). I am not giving anyone the benefit of the doubt. I just like accuracy. I guess you don't give a damn about that. So go ahead and compare apples with refrigerators if that gets you off.

jeff47

(26,549 posts)It's the subject of your post.

Except the body of your post only makes sense if you are claiming all states have graduated income taxes.

So....either your post makes absolutely no sense, or it's quite relevant to what you were saying.

I am accurately stating the amount Mitt has stated he payed in state income taxes. $0. Because he refuses to say anything else.

Or you could use this thing called "Math" and figure out that adding state income taxes doesn't invalidate the underlying argument.

former9thward

(33,424 posts)Now go outside and play. Exercise is good for young minds and bodies.

jeff47

(26,549 posts)'Cause you did try to pass yourself off as an expert.

Or you gonna keep hiding behind the "pat on the head" bullshit?

TBF

(35,069 posts)but I'm not sure if Turbo Tax would be interpreting it weirdly? I assumed they'd know what an effective rate is.

former9thward

(33,424 posts)Again, people are not stating their income. If people's effective tax rate is really what they are posting here then we have some very wealthy DUers posting in this thread.

TBF

(35,069 posts)I've done some surveys on this previously. May have sold a home and have money in savings (which will be depleted once they reach the medical conditions phase) ... and also professional folks who have pretty high incomes. Some may be confused but there is a lot of diversity on DU.

former9thward

(33,424 posts)I guess I just read a whole lot of posts from people who are not doing too well in various threads.

TBF

(35,069 posts)we have bunches of folks making under 25K - I've seen that in polls on here as well. They are probably not as likely to answer this question about effective rate because they are filling out a simple form and don't get the info we get with programs like Turbo Tax (or from the folks who do our taxes if we have small businesses, etc...).

I still think the most damning thing is that Romney will not release his taxes. Folks can rationalize a lot if they like someone, so the fact that he thinks it is a deal breaker is a big red flag.

joshcryer

(62,515 posts)edit: I guess it's closer to 4-5%

Walk away

(9,494 posts)Where are those tax returns Mitt?????

Hutzpa

(11,461 posts)but I will show my vengeance at the polls.

barbtries

(30,282 posts)and nearly that much again to the state in which i live.

Ganja Ninja

(15,953 posts)I'm in the 20 something percent range not counting my Medicare and Social Security taxes.

Aviation Pro

(14,153 posts)....fuck that goddamn splooge.

Release your fucking tax returns, fucknut.

hedgehog

(36,286 posts)aikoaiko

(34,210 posts)Jankyn

(253 posts)... my spouse and I pay an additional "gay tax" because the federal government doesn't recognize our marriage. Last year, it amounted to about 5%, bringing the total to 32%.

Not complaining, mind you; we're doing well when so many aren't, and I've got no problem with paying our fair share. I just want everybody to do so.

abelenkpe

(9,933 posts)We are both lucky enough to have well paying jobs, and don't own a home.

Who knows what Mitt paid? I find it ironic he would accuse anyone of not paying paying their fair share in taxes when his whole desire to become president is designed to make sure Mitt Romney pays less in taxes. The same Mitt Romney who has not released his tax returns and has previously boasted of paying nothing.

Anyway, among the people I know his statement seems completely false. The Obama voters I know are all successful people making good money paying their own way supporting families and paying taxes while those who voted for McCain and will vote for Romney collect some form of assistance: unemployment, food stamps, welfare, disability, social security and are so overwhelmed with bigotry and misinformation that they vote against their own self interest. The teaparty and republicans I know honestly believe that only liberals live off assistance and never see their own use of such programs as proof otherwise. They truly believe that cutting those programs means cutting those programs for everyone but themselves. They are that deluded.

JDPriestly

(57,936 posts)No scufflaws. I'm on Social Security. Others, however, are on pensions. They have more money and pay higher taxes. I'm happy with what I have. Is Romney?

abelenkpe

(9,933 posts)For working on the presidents campaign! We really need Obama to be reelected. And to win back the house.

I really don't see social security as an entitlement despite republican efforts to smear that program. I wish pensions were still the norm. 401ks are a poor substitute. ![]()

Fearless

(18,458 posts)Blue Owl

(55,799 posts)n/t

Scootaloo

(25,699 posts)It's still sliced out of each paycheck, of course! But in the meantime, my life revolves around a bank account of $0, after rent, food, other expenses. My hours are rigged to have me work the maximum possible without garnering benefits. I could really stand a trip to the dentist, but that's just not going to happen. That refund check goes straight to debts I already owed due to being the working poor.

Maybe Mittens pays a higher rate than I do - don't know, he won't release his returns! He doesn't seem to suffer for it though, so he can stop with the fucking sniveling.

harmonicon

(12,008 posts)SickOfTheOnePct

(7,671 posts)Not the all of the taxes combined into one rate.

I think the confusion is why so many people are saying they have an effective rate of over 25%.

For example, it's impossible to have an effective federal income tax rate when the top marginal rate is 35%.

ellie

(6,970 posts)whathehell

(30,117 posts)Almost 3 times what Rmoney pays, without a FRACTION of his income. ![]()

SickOfTheOnePct

(7,671 posts)When the top marginal rate is 35%?

jeff47

(26,549 posts)SickOfTheOnePct

(7,671 posts)we're comparing apples to oranges, which is useless.

JDPriestly

(57,936 posts)he seems unhappy about having to pay taxes when others who have a tiny, tiny fraction of his money pay none. The greed that demonstrates. The dependence on money that shows. That is what is disconcerting to me.

I have relatively little, relatively very, very little, and yet, I am thankful for every day of my life, thankful for living in a country in which I can speak my conscience, my mind, pretty much anonymously and freely, if I wish.

Why does Romney find the fact that people like me who live in contentment on very, very little income (no travel, no extras, no restaurants -- but enjoying what we have) so troublesome. Why doesn't he find pleasure in sharing. When I was working, and I saw the homeless and the impoverished and the children and elderly around me, I felt love for them and wanted to share. Lifting someone else's burden by paying a little more in taxes is a small price to pay for letting another person live in dignity.

I just do not understand Romney's view of the world, the bankers' view of the world. Life is so precious. Why is Romney with his three or more houses, with his ability to go and do what he wants, concerned about paying a good share of his money to make sure his society works. He does not pay taxes on the money he donates to charity. So the more he donates to others, the needy, the lower his tax rate. He should be rejoicing in the fact that he can help others.

That is what bothers me about Romney's statements in the tape -- the fact that he so resents having to share a relatively small percentage of his money. When I was working one thing I enjoyed was having the discretionary income to donate. Romney has that. He should be grateful for what he has and not worried about how much other people pay in taxes.

I worked to raise money for a homeless project for some years. There is no way that most of those charities can survive, can do their job, without tax money. As generous as people are, they do not commonly give to the homeless what is needed to keep people alive and in shelter, so the government is the donor of last resort. It is sad that we have so many homeless people in our society, but if Romney were president, if his philosophy with its disdain for the poor prevailed, we would have many, many more. Shame on Mitt Romney. Shame on these greedy Republicans.

Let's be thankful when we can help each other.

whathehell

(30,117 posts)My spouse does the taxes. I thought it was 38%, I guess it's 35 %. ![]()

SickOfTheOnePct

(7,671 posts)To have a 35% effective rate, you would have zero deductions, zero exemptions, anything.

Seriously, not trying to pick on you, it's just that we're all trying to see if we pay a higher effective federal income tax rate than Romney, but we're not even all calculating it the same way.

I paid 15.9% effective rate last year, yes, more than Romney, but nothing like the exhorbitant rates that people are saying here.

whathehell

(30,117 posts)Mr. Whathehell says his effective federal tax -- minus deductions for SS or Medicare ("payroll taxes"![]()

is about 28%...How's that sound?

benld74

(10,079 posts)Bucky

(55,334 posts)KauaiK

(544 posts)AND I was unemployed for 4 months.

Bozita

(26,955 posts)Duppers

(28,313 posts)25% here.

How many corporations pay that?

Barack_America

(28,876 posts)I received an educational stipend for which no W2 was generated. Thus the IRS had no record of my income, but I paid my 15% out of my duty as an American citizen!

goclark

(30,404 posts)DFW

(57,641 posts)Through last September, I paid the max Federal income tax rate of 35% After that, I went up to 50%.

ecstatic

(34,703 posts)Laelth

(32,017 posts)-Laelth

madrchsod

(58,162 posts)yup! i`m sponging off the government..social security and medicare. i also get a tax break on my property tax. of course i take advantage of every privilege given to me because i`m over 65!

Squinch

(55,040 posts)Skittles

(163,133 posts)YOU KNOW IT, SCHEMING DAEMONS

Cha

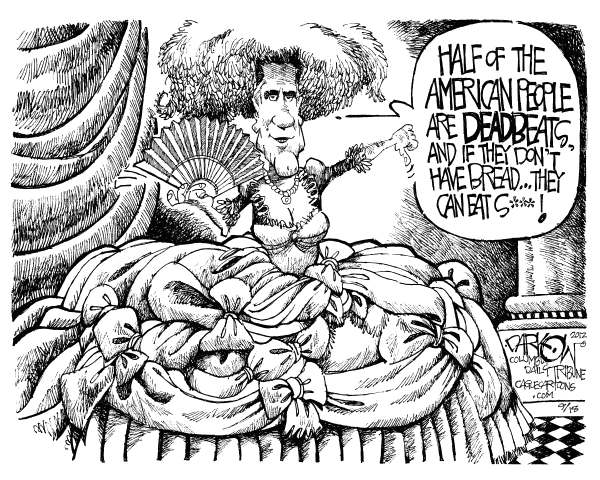

(309,318 posts)I'm Retired..but, am loving Mittantoinette's Boca Raton moment.

Ya'll know what that translates to in English, right? Mouth of the Rat.

eqfan592

(5,963 posts)Cha

(309,318 posts)bluestate10

(10,942 posts)And I don't mind paying a cent of it. I consider it the price for being part of a working society where rule of law mostly works.

TheOther95Percent

(1,035 posts)I pay 38% of my income in taxes. That does not include any sales tax that I'm sure equals another percentage point or two. Fuck Money Boo Boo.

bhikkhu

(10,775 posts)...though I'm "working poor", its a little high because of property tax (which I'm happy to pay as it funds the schools)

McCamy Taylor

(19,240 posts)joshcryer

(62,515 posts)I make about $36k so it's around there? I can't be bothered to check, heh.

lapfog_1

(30,751 posts)and even though I make a very good salary... I don't even qualify as middle class by Mitt...

Canuckistanian

(42,290 posts)FSM knows, It could be worse.

zentrum

(9,866 posts)....all my adult life.

Sirveri

(4,517 posts)correction 1/6.