General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsTake your money our of the stock market

Cancel Tesla purchases

Sell the one you have

Money is the only language now.

bif

(24,825 posts)And cancel your subscription to the WaPo and the NYT! RIGHT NOW!!!![]()

kerry-is-my-prez

(9,668 posts)poli-junkie

(1,223 posts)Maru Kitteh

(29,758 posts)Luckily, I don’t have any real money to worry about, I’m a citizen of the United States. ![]()

WheelWalker

(9,308 posts)Oopsie Daisy

(5,428 posts)* because they'll eventually rise again. Why cash-out now?

KT2000

(21,255 posts)the tariffs disappeared because the stock market tanked 600 points.

If you want to know how much trouble we are in, listen Michael Steele.

PoindexterOglethorpe

(27,435 posts)A terrifying tenth of a percent. Yeah, the market tanked all right.

yellowdogintexas

(23,104 posts)I would be quite angry with myself.

I do not look at the daily report; I set it to look back 1 year then 5. It makes me feel much better

Oopsie Daisy

(5,428 posts)Bernardo de La Paz

(53,078 posts)Getting out at the top of 1999 or 2008 would have been smart. 2021 was harsh, but clearly the full amount recovered pretty quickly (a year or two) and in larger view looks more like a blip. That would have been a good one to stay in for, in hindsight, if that is what you are talking about.

Timing the market is very difficult, but can be arranged in stages and with gradualism if one does not expect 100% accuracy. If an investor can gain even only 60 % of a bull and avoid 60% of a bear, they are doing well and will do much better than buy-and-hold or even dollar cost averaging. One can end up in the 60% by getting out early, before the final top or after a top, and buying back in too early or too late.

One way of gradualism, especially for chart readers, is if you have a discipline with trailing stops and also with pullback stops set after new buys. If you have a set of stocks and they are rising and you keep raising trailing stops, then as the market tops and turns over, one by one your stocks will get stopped out and you will have timed the market. Similarly, if you are tracking interesting stocks and they are forming bases after a bear, you can see a breakout here or there and start nibbling in. Some buys will get stopped out because it was too early. As you find more and more breakouts, you find yourself more and more invested as a bull market gets underway.

S&P 500. Notice the log price scales on the lefts. Very important must-have feature when using charts.

cliffside

(778 posts)which is difficult. Did Ok moving IRA investments, mostly in tech, end of quarter window dressing on 3/31/00. Read lots of messages, looked at charts posted, bought the Edwards and Magee book, read enough and got lucky. Then watched and waited for about three years, lots of lost sleep, before reinvesting. Did the same in early 2008, then mostly put it into rental properties. Started looking at the market before paying much attention to politics ... interesting when I saw the 10/11/2002 low was the exact date Congress gave permission to go into Iraq.

Again ... thanks! ![]()

KT2000

(21,255 posts)tank the stock market every so often so the little guys get wiped out. They then go in and clean up on low prices. A concerted effort by small investors could do the same thing. It won't happen though.

PoindexterOglethorpe

(27,435 posts)Really, they don't. Do you have any idea how many stocks are traded every day? Billions. It's been essentially since the Crash in '29 that big investors actually ran the show and did stuff like that.

Bernardo de La Paz

(53,078 posts)I think there is legal manipulation of individual stocks.

When I was watching DJT {un}Truth Social stock for interest, not invested long or short, I noticed that there would be an hour or so of a thousand shares a minute roughly and not much price action. Then all of a sudden there would be 300,000 shares traded in two minutes. The price would shoot up about 20 to 50 cents. Then over another hour or so it would deflate back down.

I think what happens is that a big investor, a tRump sycophant, buys a bunch and sells it back out slowly. They may net a bit of money, but if not, they have propped up their dear leader's shares at not much cost.

Say it was at 25 bucks. Boom, an investor puts in orders and manages to buy say 200k shares, at say an average price of 25.20 as it ends up at 25.50. Other investors like day traders notice the action and put in orders to buy, say another 100k and it goes up to 25.50. Then the first investor starts dribbling shares for sale. But they are starting that when the price is higher than their last purchase. Over an hour, they dribble out and get out before it goes below 25.20. They make a profit. Day traders and maga suckers end up holding shares bought at 25.40 average, say, when the price has gone back below 25.20.

If the big investor's average buy-in on 200k shares was 25.30, and average buy-back was at 25.20, that's a loss of 10 cents per share or $20,000. Seems like a lot, but the investor purchase cost $5,060,000. In other words, they are pushing the market for that stock around at little relative cost.

In the meantime, the stock has gotten a boost and looks active and interesting even if the boost was only temporary. I've seen it used to halt a slow decline, where it was going down as the whole market went down a bit and then it diverged and didn't go down as much as the rest of the market.

I don't have any evidence, so this is pure supposition on my part thinking through how such action might work and why.

Wuddles440

(1,661 posts)have been at or near their all time highs, right?

Wuddles440

(1,661 posts)the indexes are at or near their all time highs, right?

FoxNewsSucks

(11,009 posts)which take the non-Democratic side, and seem to support what republicons want, or want us to do.

Oopsie Daisy

(5,428 posts)Can there really be a partisan "side" when it comes to one's decisions regarding their money, savings, investments... and what their personal level of risk is... or what they expect the market to do? It's all rather personal, I imagine... and everyone has their own opinion on those things. Some are optimistic in the long run... and some are very skittish and averse to any risk at all, ever.

Are you disappointed in my reply, or disappointed in the post I was replying to?

we are going to lose our country.

MineralMan

(148,676 posts)Do tell.

KT2000

(21,255 posts)when I realized how the big guys manipulated the market to clean out the small guys.

I am trying to think of real ways to affect what is happening now. This is an attempt at a discussion. Fascism succeeds because no one stands up against it when it begins. I have studied Mao in China, Hitler in Germany , and Orban in Hungary. The people acquiesce out of fear and discomfort. I am seeing that his country will behave the same. Your sarcastic, dismissive response proves my point.

I don't have money but I am speaking out publicly for people to remember their humanity - not just make posts to DU.

PoindexterOglethorpe

(27,435 posts)the market and clean out the small guys.

I've been investing, and more to the point staying invested, for nearly 50 years now. Oddly enough, my account is worth more than it ever has.

ProfessorGAC

(71,864 posts)Boycotting products, I guess I can understand.

But, not sure what shedding equities achieves.

What do you presume is the outcome?

Abolishinist

(2,277 posts)along with a similar decrease in one's net worth?

SouthernCal_Dem

(959 posts)Dividends and interest are taxed though assuming you’re holding the assets in a taxable account.

Abolishinist

(2,277 posts)The implication of "take your money our (SIC) of the stock market" and "dumping stocks" to me, especially in any forum where from time to time one makes a few presumptions regarding intent, IS selling off all stocks (possibly other investments as well) in one's portfolio. Which could, and in my case would, result in a tax on capital gains.

ProfessorGAC

(71,864 posts)It seems like a protest without a point.

sakabatou

(44,217 posts)PoindexterOglethorpe

(27,435 posts)Depending on exactly how you invest, you may want to adjust things somewhat, but notice that the market is STILL at (or very close to) all time high, even a full week after Trump was inaugurated. What does that tell you? That the market is going to crash into oblivion real soon now? Really?

I can tell you that my wonderful investment advisor, a very conservative guy, isn't saying anything about my selling anything.

bif

(24,825 posts)My investment advisor is conservative as well. (Borderline tRumper), but he's having me hold everything. Even when I told him I was thinking about selling a bunch of stock and putting it into a MMA>

PoindexterOglethorpe

(27,435 posts)Of course, it's amazing how many people here seem to be day traders, buying and selling, selling and buying.

Going for the long term is vastly better.

MichMan

(14,438 posts)According to some, a 800 point loss in the Dow was indicative of a complete crash, even though it has dropped more than multiple times the last few years.

bif

(24,825 posts)Bernardo de La Paz

(53,078 posts)"Timing the market" to get out at tops and in on bottoms is very difficult but some attempt has to be made or else big bear markets can wipe you out and take a decade to claw back.

Dollar cost averaging is one way that effectively times it to a small degree, if you can maintain a steady stream of new money coming into the account. Portfolio rebalancing can have a similar effect, where when stocks get high, they get over-weighted which triggers a little selling during rebalancing that fattens the cash portion. Then when stocks go down a bit and cash is a bit overweighted, there is a bit of cash to buy the cheaper stocks. But these are kind of blunt instruments.

Hekate

(96,614 posts)surfered

(5,426 posts)PoindexterOglethorpe

(27,435 posts)I'm sure you're quite pleased.

Bernardo de La Paz

(53,078 posts)Dow is up 6 percent from about 42,200 Nov. 5 close, up 2,500. But the Dow is not the best proxy these days. S&P up 5%.

But nobody here bought on Nov. 6, I'm sure. In any case, by time retail investors could buy stocks or stock funds on Nov. 6 it had already jumped.

It is especially noteworthy that all of that gain was made in the first month. Since then, the market has been very choppy and moved sideways. Hence risky, especially late in a 2 year bull market in a highly disrupted economic environment where president Muck is "moving fast and breaking things".

You have been counselling people to stay in the stock market even as you are sliding out of it into bonds. You have been counselling people to not to try to time the market. So you of all people should know that a 5 percent bump is not something to fret about or particularly celebrate.

When people get out of the stock market like surfered and myself, ahead of a top, they don't mind being a few percent early. They'd rather be a bit early because being a bit late or trying to be a bit late is very risky. A sudden bear drop is much more likely than a sudden bull boost.

But who knows. I could be very wrong; the market could zoom for years and tRump could be an economics genius. He says so. Do you think he is one?

surfered

(5,426 posts)sinkingfeeling

(54,467 posts)berkerly6240

(86 posts)and this idea wont result in its intention.

KT2000

(21,255 posts)for replying reasonably.

Bernardo de La Paz

(53,078 posts)Right now, the orange chaos agent is making the market risky.

Tariffs are inflationary initially as prices rise. Then they are deflationary as they sabotage consumer spending and cause job loss. That's "politics" of today.

There are two massive disruptions in the labor market: mass deportations and drastic government job cuts. Both are "politics" and both are contractionary.

But if you are saying don't use investing / not investing as a tool to punish dictators, you would be right because it is too easy to make a big investment mistake that way. If you just invest / disinvest according to your best pro advisor or best personal assessment, then those market signals have the intended effect. Take care of your investments and you will send the right signal.

DetroitLegalBeagle

(2,306 posts)I'm not messing up my retirement to make some political statement. I feel bad for those near retirement who still have high exposure to the markets. But I'm not retiring for another two decades at least. As far as I'm concerned, trump crashing the market at this point in my life would be a boon. I have both the liquidity to invest more and the time to ride it out and see the market rise again. A market crash now is basically a stock sale for me.

ck4829

(36,742 posts)Money is the only language now - So let's talk about evictions, foreclosures, bankruptcies, wage garnishments, liens, debt collections, and more. These are all things that should not be happening in a strong economy.

The stock market predicted a quick Iraq war.

about the stock market but Donnie Dollhands does. So far that is the only thing that moves him.

The stock market celebrates increasing unemployment, reduced wages, minimal healthcare, more private prisons, shuttering health facilities by equity firms, increased prices, obscene CEO pay and bonuses and more.

radius777

(3,903 posts)Even if campaign donations were better limited politicians would still act in favor of big business, in order to keep the market going up which voters ultimately want. I don't fault people for investing, but as long as our fates are so tied to the market, then the market will get what it wants, which is often unethical and ugly policies that mostly benefit the rich.

Karma13612

(4,733 posts)Many companies put their employees pensions into the market whether by 401K’s or by them investing for their employees. Either way, yes, our country is very tied to the stock market.

PoindexterOglethorpe

(27,435 posts)have you bothered to calculate how much money you've lost so far?

I just had my quarterly chat with my investment guy, and he's shifting some of my stock funds to bond funds. Meanwhile, thanks to his strategy of not going for the biggest possible returns, but get returns and minimize the downside, and he's done very well for me. My portfolio was up 12% last year, And up the same amount in 2023. We increased my take-home money by a couple of hundred dollars, which is nice.

MichMan

(14,438 posts)Mostly lots of talk about what other people should do.

Bernardo de La Paz

(53,078 posts)I haven't been invested for decades but was able to get back in in 2024 into a stock fund. Thus far I have not yet been able to follow enough stocks or get set up for a disciplined approach to investing in individual stocks like I want to and did decades ago. Then I had stops on stocks and was mostly out by the crash of 1987 (Black Monday).

I got out in January and into a bond fund. My reasoning is that the bull market is old, and that the orange chaos agent was making things too risky by January. I expect the market to go up and make some new records but not by much. I expect I am out before the peak, but I am peaceful and am out before a potential quick big drop.

There is irrational exuberance among conservative investors about the prospects of a tRump bull market (continuation of Biden bull market) and expected interest rate cuts. Such widespread sentiment ("I'm fully invested and going to stick with it" ) is common at bull market tops.

The problem is that conservative investors and advisors -- conservative in that they use simple strategies like buy-and-hold and dollar cost averaging (the best simple strategy when combined with portfolio rebalancing) -- the problem is that they expect things to more or less continue as before with only a few ripples and generally "steady as she goes" with all the usual indicators and aphorisms applying. They have not yet fully realized how chaotic things are getting rapidly. Tariffs (inflationary initially, depressive longer term) and labor force disruptions (massive govt layoffs and immigrant roundups) lead to job loss, contraction in consumer spending (60% of economy) and recession or worse. Drastically reduced government spending is depressive. Massive tax cuts for the rich do not stimulate the economy much, because the rich already have a lot of cash and have a lot of stuff parked in illiquid assets like real estate and artwork.

So I expect a brief inflationary bump, and then interest rate cuts that don't stimulate the economy or the markets as much as expected because of the other severely contractionary forces. Then I expect an extended recession, probably longer than average, probably more like two years, until the effect of the 2026 Congressional elections (blue wave) start to put things back together again, and I hope a blue wave in 2028 for the Presidency.

I am foggy about bonds, but my thinking is that as interest rates decline, even if the economy declines, then the bonds that the fund already owns become more valuable.

My goal is to dabble a bit in puts and conservative option strategies on the downside, and then start picking up stocks carefully and slowly when I judge the stock market may be coming out of a bottom, in 2026, 2027, or later. I don't know when, but the market will tell me.

Karma13612

(4,733 posts)🤣 All kidding aside. I really appreciate your reasoning.

As mentioned in detail elsewhere in this diary, I pulled my 401K out of the stock market and put it in US Treasury Bonds on November 15th. I could see things getting unstable.

As long as our US Treasury can withstand the Musketeers bullcrap, I have a steady principal and even make a bit in interest every month. My Trump-loving Conservative financial advisor tried gently to steer me away from this move. But, he’s 50 and I’m 71. No matter how hard people try to divorce themselves from instinctual personal bias, it’s there. He has years to recover from another market bust, I don’t.

PoindexterOglethorpe

(27,435 posts)Look post # 61 by Bernardo de la Paz. Also note that recessions are shorter than ever.

Without knowing anything about you aside from your name and what you've posted, 71 isn't that old. A quick internet search says that a typical 71 year old American will live another 16 years.

I am very grateful for my financial advisor.

Bernardo de La Paz

(53,078 posts)It took more than 10 years for stocks to recover. That is indeed years to recover. Then there was a dot.com bubble. Now there is a bit of an AI bubble.

The current situation is more like 1999 than 1949.

Karma13612

(4,733 posts)Market roller coasters of 1999, and 2008, and then more recently, just can’t remember the exact timing. I pulled out on November 15th as the market was falling following Election Day. I cannot weather another tanking.

I’m 71 and cannot recover from another huge dip. I need this principal to begin using it probably starting next year. Or sooner if Musk decides granny should just do without her Social Security which she fcking paid into her entire working life.

All of you saying to hold on tight probably have years to recover. I can’t risk it.

I’m in the US Treasury Bonds now thru my investment company. My principal won’t go down. And so far I have actually gained back everything I lost from my high point on Nov4th until when I actually transferred it on Nov 15th. Yea, I’m angry that the market has gone back up, but I am no longer afraid of another huge dip.

PoindexterOglethorpe

(27,435 posts)Yes, I know very well that the market goes up and it goes down. I also know that staying invested makes money. So, if my portfolio has been up 12% two years in a row, I should sell?

I'm 76. Of course I'm staying invested. As I've noted, my guy is moving my money into bonds at present, which seems like the right idea at this point.

Bernardo de La Paz

(53,078 posts)Past performance is no guarantee of future results, especially this late in a bull market.

When people say the market, they mean the stock market, unless another context is specified. The thread title even says "stock market". The suggestion was "out of the stock market", not "out of investing".

Karma13612

(4,733 posts)US Treasury Bonds thru my investment company.

You are using the phrase Stock market too broadly.

Stock market is stocks

Bonds are bonds in the money market category.

rzemanfl

(30,466 posts)Cirsium

(1,933 posts)How dare you express a lack of confidence in Wall Street? Greed is good. We are making a lot of money from this catastrophe.

![]()

every day is enlightening

now I am really scared for the future.

Cirsium

(1,933 posts)I would bet that the likelihood of a person advocating for "business as usual" is directly related to the amount of money they have in the market.

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”― Upton Sinclair

I recall an economist saying in an interview that he has come to the conclusion that the end of the world will come about because people want to keep their jobs. So, it is.

Cirsium

(1,933 posts)"I fooled myself. I had to. Everybody has to. If the good had been twice as good and the bad only half as bad, I still ought to have see it, all through as I did in the beginning, because I am, as you say, sensitive. But I didn't want to see it, because I would have then had to think about the consequences of seeing it, what followed from seeing it, what I must do to be decent. I wanted my home and family, my job, my career, a place in the community."

They Thought They Were Free: The Germans, 1933-45

Milton Mayer

KT2000

(21,255 posts)We have had the lesson of the holocaust. At age 5 I went to my friends' houses and saw grandmas with numbers tattooed on their arms. I learned about the human cost at that time and committed to speaking up if it happens again. I have been obsessed with the question of how this was allowed to happen - and it was allowed.! I learned about fascism in Germany from my Jewish friends, the fascism of Mao in China from my friend (who still sings the praises of Mao she learned in grade school), It is happening here.

I made a pitch on a local chat to respect our Canadian neighbors by buying a pin that had the US and Canadian flag joined at the pole. We live across the water from them, and they have rescued people here on numerous occasions. They even saved a whale that beached itself on our bay.

A few wanted to express affection for our neighbors and others wanted the post kicked off for being political. Still other had incredible information about the huge amounts of fentanyl they sent to the US (.02% of seized fentanyl). I made a pitch for humanity, not politics. We can even do small things that show that people are watching and speaking up.

Thanks for listening.

TheProle

(3,290 posts)You misspelled “want to provide their families with food and shelter.”

We sure are grateful to those job creators - said every Republican ever.

Your comment is extremely reactionary.

what the economist said.

Horrible things are done for employment and that is the truth. Our local organic farmer was a chemical engineer at 3M. He realized he was involved in human experimentation because they were not concerned with health effects. He quit and spent his life providing organic produce for our community. 3M's consumers who did get sick may or may not have had access to healthcare. Yes, their products have made people sick.

In order to keep her job, a friend did not divulge that the dentist she worked for reused syringes and stored them with blood still on them. (they had patients with HIV and hepatitis). She would get in early and clean and sterilize what she could. She reported to the health department after she left, and the remaining workers lied to keep their jobs during the inspection.

It is a fact of life some will compromise and some will not. That is where humans make choices as to how far they will go.

TheProle

(3,290 posts)After all, it is not as though we have finite resources and only one planet to trash out, or anything. Endless growth! Full speed ahead!

do no such thing!

Disaffected

(5,421 posts)in my long years (>50) of investing in the stock market are:

1) buy and hold for the long term,

2) don't give stock market timing advice (or much other advice for that matter)

Bernardo de La Paz

(53,078 posts)Raftergirl

(1,641 posts)I’m not selling anything but what other people decide to do is none of my business, as what I do isn’t any one else’s business either.

kimbutgar

(24,480 posts)I spread it between two funds and now I’m afraid I will lose it.

yaesu

(8,622 posts)about President Musk getting his hands all our financial records. Whether you believe it or not call, think of it as a protest.

bucolic_frolic

(49,178 posts)Doctors use standard care and manage the effects of lifestyle and bad diet with medications because they know the public won't alter their diet.

Financial advisors are accredited and registered with FINRA, to protect the public from bad advice. All the software cranks out diversity, equity, and inclusion in a different form than we usually discuss. We pay dearly for this advice.

Index funds spread the risk as they concentrate in 11 large cap companies. Many ETFs do the same. When the bubble bursts there will be no place to hide. Everyone will want out of mega positions and no one will be large enough to buy.

We are so strapped in there's no way to excel in anything.

Warren Buffet followed his own insights. Many millionaires and billionaires rode a concentrated investment in their own company.

Little people are told they are safe if they're diversified and follow good advice.

See why no one gets ahead?

Hotler

(12,806 posts)The banks collect no fees when transactions are cash. Mom & pops love cash.

Another way to stick it to the banks (if it's possible for you) is to pay off you CC balance each month. The banks hate that big time because you're using their money free for 30-days.

Do not underestimate the power and leverage of your consumer dollars and your choices when shopping. Their money flow is their weakness.

Blue Full Moon

(1,839 posts)Texasgal

(17,209 posts)What TESLA?

Seriously?

Xolodno

(6,884 posts)Investing is a long term practice, not a short term unless you have something specific in mind. And selling and driving the price down does little to the company. But someone will be glad to pick up a bargain. Not too mention you expose yourself to more tax liability (grifters running the gov would like that).

I don't own Tesla stock...in my side accounts. But I'm thinking about it. I think Musk bit off more than he can chew with Twitter by either:

1. Paying too much for it.

2. Driving the value down due to dumb decisions.

3. Combination of both.

I'm leaning on No. 3. He's going to have to make a decision, double down on his bad deal which means he may have to sell out or relinquish control of Tesla, which would probably increase the value. Or puts his bad deal in receivership. Depends on his ego. Toyota hasn't made many inroads into electric vehicles, maybe they are waiting to snatch a company up.

Polybius

(19,395 posts)And I made tons in stocks last year.

KT2000

(21,255 posts)you are in the habit of flipping people off and feeling good about it. Lovely, but try to remember your humanity. People do have different opinions.

Polybius

(19,395 posts)But I've been flipped off for seemingly no reason. Likely it was because of my car.

Not to try and sink the market but to protect my money.

It's now in a 7 month CD. Definitely a smaller return than average returns over the life of my investments but a better average return than a conservative investment strategy. I'm too old to ride it out now. We'll see how things look when it matures.

Honestly I'm worried about a lot more than a smaller return on investment.

ibegurpard

(16,998 posts)And put it into a CD without paying tax penalties or taxes as long as you aren't taking possession of the proceeds.

You can always put it back in if things seem like they're stable to you.

cliffside

(778 posts)"Legendary technician Richard Wyckoff wrote about financial markets in the early decades of the 20th century at the same time as Charles Dow, Jesse Livermore, and other iconic market analysis figures.

His pioneering approach to technical analysis known as the Wyckoff Method has survived into the modern era. It continues to guide traders and investors in the best ways to pick winning stocks, the most advantageous times to buy them, and the most effective risk management techniques to use.

Wyckoff’s observations on price action coalesced into what’s known as the Wyckoff market cycle. It’s a theory that outlines key elements in price trend development that are marked by periods of accumulation and distribution. Four distinct phases comprise the cycle: accumulation, markup, distribution, and markdown... "

Bernardo de La Paz

(53,078 posts)Celerity

(48,480 posts)Bernardo de La Paz

(53,078 posts)Your post implies that an investor thinks a market is either a buy or sell and they should go all the way one way or another.

A multi-valued approach includes the possibility of holding cash or other instruments like bonds while being out of stocks, neither long nor short.

I simply think the market is too risky right now. I'm neither long nor short. I do think it is topping, but I could be wrong. I think the risk of a bear market outweighs the risk of missing some small gains from the tail end of a two year bull market during a time of orange chaos.

Your post further has another fallacy: that the main prediction is "soon plummet". In actuality, a person might think that a market will soon plummet or plummet before long or plummet after an extending topping period or plummet in any of those three ranges hence an unknown future point that could be sooner or later.

A third fallacy implicit in your post is the idea of being all long or all short (short the market). One can be all long, partly long, mixed long and short, out, partly short or all short.

People investing in mutual funds or ETFs can be in funds or in cash to varying degrees.

People who invest in individual stocks can let the stocks reveal their patterns individually. If they use trailing stops (either long or short) they will find that as markets top out and begin to roll over, they get stopped out of more and more stocks. Similarly if they have short positions in stocks as a bear market bottoms out.

Celerity

(48,480 posts)the immediacy and the negativity, not me. I would never suggest someone trades into a completely one-way posture, be it bull or bear.

Bernardo de La Paz

(53,078 posts)You were calling out people who think the market was going to "plummet soon", again implying that there is only the choice "plummet soon" or not plummet soon. There is always the third option: I don't know. Beyond that there are more choices in reality, such as "expect sideways for a while", "yee-haw bull market is still on", "it's going gradually drift up", etc.

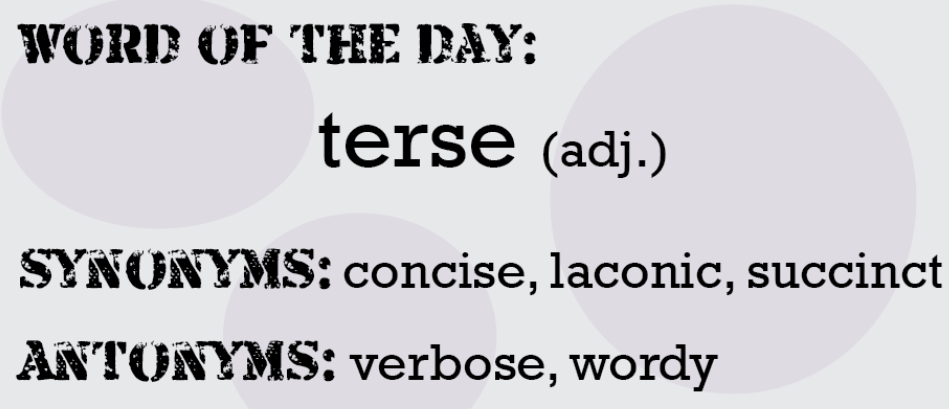

And given "plummet soon" for the sake of discussion, you implied you were so dismissive of that position or maybe the "soon" part (we don't know because you were so terse) that big bold decisive action was the only option you presented.

As to "ALL their money", when confrontationally saying "short the market", that again implies big bold action and a lot of their money.

But regardless, assume I was mistaken in reading implications. I the reader am being blamed for the terseness of your post. If you want to avoid being misunderstood by weak readers like me (who knows, I can only guess implications) then spare a few more words to prevent it in the first place.

Celerity

(48,480 posts)

Bernardo de La Paz

(53,078 posts)radius777

(3,903 posts)to bearish critique - but one that fails to appreciate that shorting is not simple and has unlimited downside risks, thus most people won't do it even if it is justified.

DFW

(57,428 posts)In 1998, I bought 500 shares of Apple for $38 a share. On “expert advice” from the broker back in the States, I sold it many years ago. About $3 million too early, it turns out. Maybe that’s pocket change to some, but to me, that would have been one huge chunk of pocket change, even after paying the capital gains taxes. After that, I forbade them to touch anything, and told them I never wanted to hear any more advice from them ever again.

As for what’s left, I’m not giving Musk my capital gains taxes to grab unless I desperately need to sell something. I still work for a living, so I still have a little bit (I pay about 73% in income taxes) of salary to live off.

kerry-is-my-prez

(9,668 posts)He had started talking about tariffs - which I knew would be a disaster. Also deporting the workers that we need. My whole town in Florida runs by immigrants - I know a lot of them are illegal - I’m a social worker.

Karma13612

(4,733 posts)I’m retired (71) and have a meager 401K. I watched the value drop steadily after Election Day. So MidNovember, I transferred it all into the US Treasury Bond Fund thru my investment company.

If I take it out and stick it in a traditional savings account I’m hit with a huge tax penalty so I guess I’m praying the Treasury doesn’t tank.

I give up. Plus, I am petrified that Musk with stop or severely reduce my monthly social security check which I completely rely on.

PoindexterOglethorpe

(27,435 posts)over 2,000 points since Election Day, at record highs for months no, how on god's green earth do you have a 401k that is losing money? You need to be in different funds. Dear lord, the Dow is up over 6,000 points in the last year. You must have the only 401k that is losing money. Get out of it.

Again, in no small part thanks to an excellent advisor, my portfolio is up 12% two years in a row. It takes a special investor to lose money in such a strong bull market. I'm impressed.

Bernardo de La Paz

(53,078 posts)Last year is last year. Past performance does not guarantee future results, especially late in a bull market.

Dow is up 6 percent from about 42,200 Nov. 5 close, up 2,500. But the Dow is not the best proxy these days. S&P up 5%.

But nobody here bought on Nov. 6, I'm sure. In any case, by time retail investors could buy stocks or stock funds on Nov. 6 it had already jumped. So realistically, the rise is less than you cite

It is especially noteworthy that all of that gain was made in the first month. Since then, the market has been very choppy and moved sideways. Hence risky, especially late in a 2 year bull market in a highly disrupted economic environment where president Muck is "moving fast and breaking things".

When people get out of the stock market ahead of a top, they don't mind being a few percent early. They'd rather be a bit early because being a bit late or trying to be a bit late is very risky. A sudden bear drop is much more likely than a sudden bull boost.

But who knows. I could be very wrong; the market could zoom for years and tRump could be an economics genius. He says so. Do you think he is one?

radius777

(3,903 posts)for most people, especially low cost index funds. Those who are invested should probably stay invested, especially if they have a long term horizon.

However, if someone is thinking about getting in now and/or has a short term horizon - just doesn't seem wise IMO.

The market historically goes up, but that was under normal presidents, under a stable and predictable system. Even Trump's first term was somewhat normal due to the guardrails and establishment Republicans that controlled his worst impulses. Now that's all gone, and the USSC has determined that he's immune from consequences, and the stable order we (and the market) took for granted no longer exists.

DFW

(57,428 posts)I can't touch my Roth IRA, since although under US law, I have paid the taxes in full when I converted, the Germans don't recognize that, and want another 50% of any distributions I take (so I don't).

Ironically, the Germans don't tax capital gains on stocks ("speculations" ), but the US does. The market IS kinda high right now, but I'm not in dire need of the money just yet, and I can't seem to find any volunteers to pay my US capital gains taxes if I sell now.

There are exactly two countries left in the world that do not recognize residence-based taxation. One is Eritrea. The other is the United States of America. It complicates questions like this one.

JohnSJ

(98,069 posts)the future, or their kids education.

No one should cut off their nose to spite their face.

It ain’t the stock market ; it’s the Dollar. Put all $$ in non-US equity and bond mutual funds.

Bernardo de La Paz

(53,078 posts)AkFemDem

(2,453 posts)Oh sure, let me go sell my stocks, cancel my mutual funds, hey may as well cash in the hubs 401K and my TSP since they are also invested into the markets... oh wait, and kiddo's 529 college plan too, that'll be a smart choice! ![]()

I have to agree although I think the point has been made in sufficient quantities already. One thing that I haven't seen mentioned and sorry to have to say it is the absolute best protection against economic turmoil is to get rid of (if you have any) your consumer debt, HELOCS, primary mortgages and create a cash emergency fund and a FU money fund. That gives you the ultimate flexibility under any circumstances and reduces reliance on external income sources or a lost job, things that ore out of your control. With no debt and a cash savings, if the market tanks we are not immediately in panic mode and if the economy goes south, the same thing.