Florida Residents 'Stuck' as State's Largest Insurer Cuts Policies

Source: Newsweek

Published Oct 28, 2024 at 5:00 AM EDT | Updated Oct 28, 2024 at 5:14 AM EDT

Florida homeowners have told Newsweek they are being "ripped off" and put into financial difficulty as the state's largest home insurance provider moves to cut the number of its policies.

Earlier this year, regulators in the Sunshine State approved proposals allowing private insurers to take policies from Citizens Property Insurance Corporation as the number of policies has soared in recent years. Citizens, created by the Florida Legislature in 2002, provides insurance to eligible Florida property owners who cannot find insurance coverage in the private market.

"Citizens is committed to helping its policyholders find coverage in the private market," its website reads. "As required by Florida law, Citizens' Depopulation Program matches Citizens policyholders with insurance companies interested in removing their policy from Citizens and providing private-market coverage for their policy."

Despite being the insurer of last resort in the Sunshine State, the number of Citizens policies has ballooned in recent years as private insurers dropped customers and raised rates due to losses caused by payouts and litigation. As of the end of September 2024, Citizens had 1,263,055 policies in force. Five years ago, in September 2019, it had 421,332 active policies.

Read more: https://www.newsweek.com/florida-residents-stuck-citizens-insurer-cuts-policies-1974795

Ray Bruns

(4,604 posts):![]()

twodogsbarking

(12,228 posts)Just a thought. The highest places in Florida are, well, bridges. Over, what else, water.

Freethinker65

(11,141 posts)banning masks, sending the national guard and or planes to TX for photo ops, etc.

Who really needs house insurance anyway?

C0RI0LANUS

(1,354 posts)snowybirdie

(5,632 posts)Rick Scott as governor, brought in substandard insurance companies into the state and was the beginning of the insure crisis. Of course climate change is a huge factor.

DEBBIE FOR SENATE!![]()

Jit423

(296 posts)It is astonishing that most Americans are so ignorant about how capitalism works and who ties the hands of government from doing more to help the 98%.

Truth is, if unearned tax rates and income tax rates were raised to 50% for individuals with both kinds of income over $1000000 every billionaire would still be a billionaire if they paid their taxes with no loopholes.

Many voters today who lived and were raised in the 50s and 60s when tax rates for as much as 70% on the uber wealthy remember that low and moderate income families could afford a home, buy a car, pay insurance, pay the ice man, the milk man, and buy food without feeling as depressed as they do today as millionaires.

Now we are living in a time when having it all is not enough. This seems to be a time when "having it all" means others should have none. And it is not just in the USA where this seems to be the trend, it seems to be world-wide.

I can't wrap my head around it. My brain hurts.

Hugin

(34,604 posts)Well said! ![]()

Along with tax balancing, if I had any say, the paradigm of awarding middle management bonuses based on so-called “cost savings” pioneered by that Jack Welch ass would be eliminated. It’s a race to the bottom. Leading to chronic understaffing, cronyism, corruption, nepotism, and dangerous corner cutting. All for what? A very small percentage of the take.

travelingthrulife

(727 posts)n/t

Biglinda 52

(87 posts)with one paycheck. Has nature found a reason for the existence of billionaires?? They're kind of worthless. They think they are so smart and as we can see---NO! They are leeches that suck the life out of the rest of society.

Tarzanrock

(457 posts)Live by insurance "deregulation," die by insurance "deregulation." Sleep in the bed you built, Florida Republicans. You did it to yourselves, Florida. Clean up your own insurance mess. You may begin by voting every Republican Nazi out of office forthwith in this next election.

C0RI0LANUS

(1,354 posts)

Gov. Scott must have done a wonderful job for Floridians before DeSatan took over the helm.

BTW: According to Open Secrets, Florida US Senator Rick Scott’s net worth was estimated to be $259,663,681 in 2018. Scott’s assets range from $270,838,240 to $808,320,000. Scott has no liabilities, making these figures his actual net worth.

Is Senator Scott accepting his $174,000 per annum senator's salary?

Source:

https://finbold.com/guide/how-rich-is-florida-senator-rick-scott-rick-scotts-net-worth-revealed/

moreland01

(834 posts)It reminds me of how you have to have very little personal wealth to get Medicaid. This is one way to siphon off a person's wealth before they die. Long Term Care is similar. It's so expensive that a lot of people will be left with nothing.

Perhaps Florida is trying the same thing. Insurance Companies don't want to pay insurance claims and they'll try their hardest not to. Eventually all policies will be too expensive for most. What then? You lose your last vestige of wealth (your home) before you die.

The only people protected are the uber wealthy who have trusts and various other ways to protect their wealth to assure it's around for their heirs when they die.

C0RI0LANUS

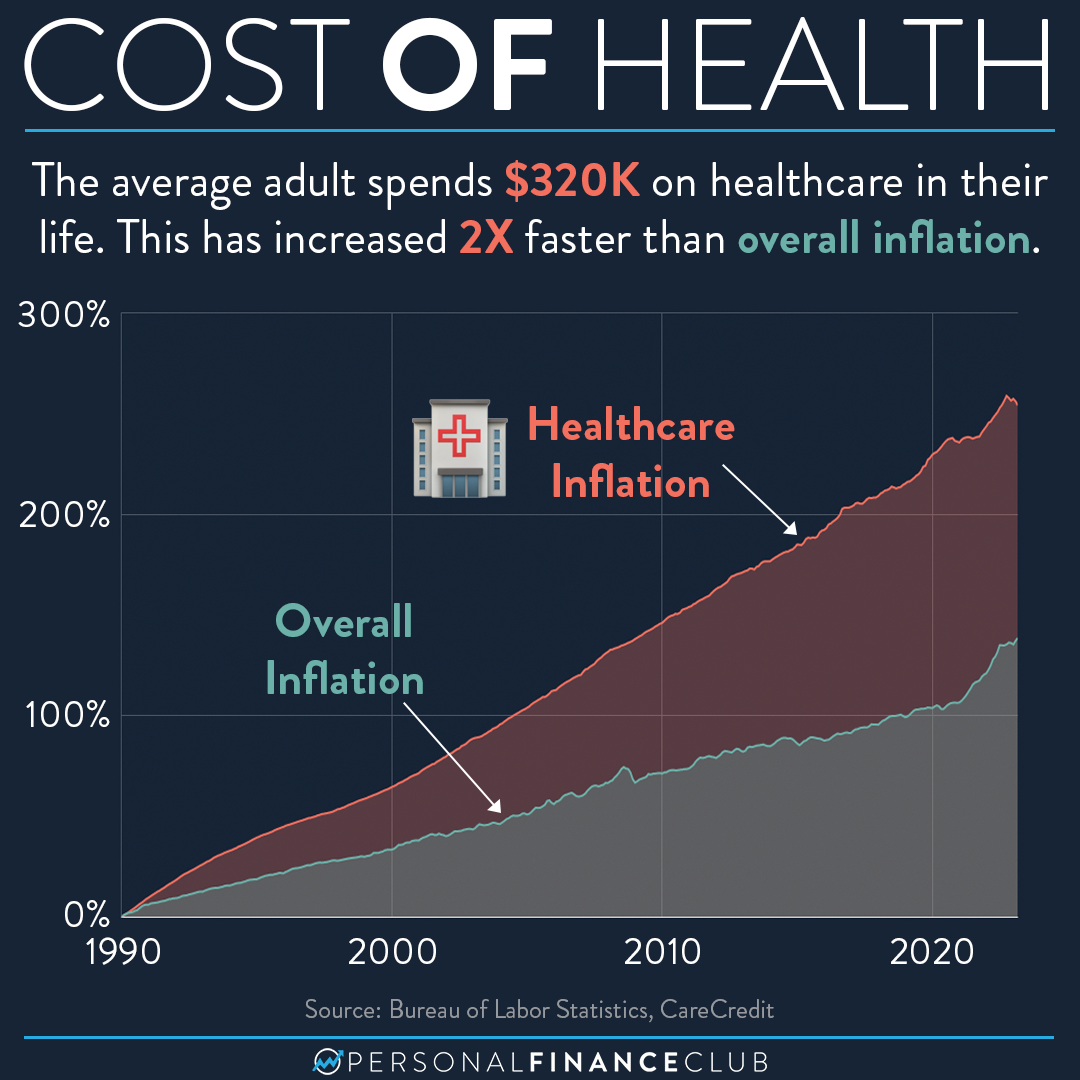

(1,354 posts)Our system protects the wealthy and their heirs from sudden shocks such as property damage in Florida or health issues requiring expensive medical care, but it does protect not the average American unless they have all the right insurance policies. President Obama tried to fix this with the ACA.

And the system extracts wealth from us at the end of our lives as well. In the past 30 years, funeral expenses have risen by 227%. Again, another issue the wealthy do not suffer from.

According to an MIT study, many Americans die with ‘virtually no financial assets.’

Sources:

https://choicemutual.com

https://news.mit.edu/2012/end-of-life-financial-study-0803

No expense too high for the late Ivana Trump's 20 Jul 2022 funeral. Her enormous casket required ten men to lift.(Credit: LG Jr. / RG for Fox News Digital)

Dan

(4,096 posts)There’s something else in that casket.

C0RI0LANUS

(1,354 posts)Makes us wonder what's in there besides Ivana.

Maybe Geraldo Rivera will do a TV special on it in the future like he did with "Al Capone's Secret Vault" so many decades ago. The youngsters may not remember that spectacle:

SupportSanity

(1,125 posts)Insurance companies base their costs on risk.

The planet is a riskier place to live. Some places are feeling it first.

Bayard

(24,145 posts)When we still had one we were required to have a separate flood insurance policy, even though all we have is a drainage ditch over beyond our yard that flows if we get a bunch of rain. If we didn't keep up the insurance we lost our mortgage.

JoseBalow

(5,184 posts)Or stick around and keep rebuilding at your own expense while waiting for the sea to swallow you up. ![]()

Deep State Witch

(11,265 posts)I do "Zillow porn" on my MIL's area in Venice, FL. There are hundreds of properties for sale. Three on her little cul-de-sac.

JoseBalow

(5,184 posts)I know there are always "investors" ready to low-ball distressed properties to eke out profits on thin margins. There's never a shortage of predatory buyers. Does it make sense to accept the loss and move on? The alternative seems to be throwing away good money after bad. Maybe a few more hurricanes and uninsured losses might help along the decision making process for some.

FakeNoose

(35,702 posts)We're all paying the price for these big storms. If the insurance companies don't do something now, there won't be any affordable insurance because they'll all be out of business.

![]()

![]()