Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent.

Tue Oct 19, 2021: On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent

I had just started a new job. The old timers saw a lot of money disappear that day. {ETA: on paper, as people noted last year. If they didn't have to sell right away, they came out okay.}

Black Monday (1987)

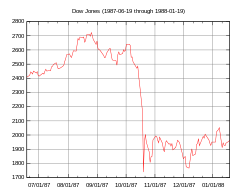

DJIA (June 19, 1987, to January 19, 1988)

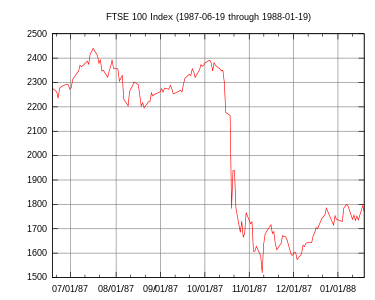

FTSE 100 Index of the London Stock Exchange (June 19, 1987, to January 19, 1988)

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on October 19, 1987. In Australia and New Zealand, the day is also referred to as Black Tuesday because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% (Malaysia, Mexico and New Zealand), and three by more than 40% (Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

{snip}

DJIA (June 19, 1987, to January 19, 1988)

FTSE 100 Index of the London Stock Exchange (June 19, 1987, to January 19, 1988)

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on October 19, 1987. In Australia and New Zealand, the day is also referred to as Black Tuesday because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% (Malaysia, Mexico and New Zealand), and three by more than 40% (Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

{snip}

Thu Oct 15, 2020: On October 19, 1987, Black Monday happened.

{Corrected. Original, and wrong, title, referring to a different drop in the Dow, on October 15, 2008:

"On this day, October 15, 1987, Black Monday happened."

For that event, see:

Sat Oct 15, 2022: On this day, October 15, 2008, the DJIA dropped 733 points.

Edited on Sat Oct 15, 2022}

Oh, boy, I remember this one. I didn't have a whole lot in stocks at the time. Another one of these would be disastrous.

Black Monday (1987)

DJIA (June 19, 1987 to January 19, 1988)

Date: October 19, 1987

Type: Stock market crash

Outcome:

Dow Jones Industrial Average falls 508 points (22.6%), making it the largest one-day drop by percentage in the index's history.

Federal Reserve provides market liquidity to meet unprecedented demands for credit.

Dow Jones begins to recover in November 1987.

NYSE institutes rule regarding trading curbs in 1988.

FTSE 100 Index of the London Stock Exchange (June 19, 1987 to January 19, 1988)

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on Monday, October 19, 1987. In Australia and New Zealand, the day is also referred to as Black Tuesday because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% (Malaysia, Mexico and New Zealand), and three by more than 40% (Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

The degree to which the stock market crashes spread to the wider economy ( or "real economy" ) was directly related to the monetary policy each nation pursued in response. The central banks of the United States, West Germany and Japan provided market liquidity to prevent debt defaults among financial institutions, and the impact on the real economy was relatively limited and short-lived. However, refusal to loosen monetary policy by the Reserve Bank of New Zealand had sharply negative and relatively long-term consequences for both financial markets and the real economy in New Zealand.

The crash of 1987 also altered implied volatility patterns that arise in pricing financial options. Equity options traded in American markets did not show a volatility smile before the crash but began showing one afterward.

{snip}

DJIA (June 19, 1987 to January 19, 1988)

Date: October 19, 1987

Type: Stock market crash

Outcome:

Dow Jones Industrial Average falls 508 points (22.6%), making it the largest one-day drop by percentage in the index's history.

Federal Reserve provides market liquidity to meet unprecedented demands for credit.

Dow Jones begins to recover in November 1987.

NYSE institutes rule regarding trading curbs in 1988.

FTSE 100 Index of the London Stock Exchange (June 19, 1987 to January 19, 1988)

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on Monday, October 19, 1987. In Australia and New Zealand, the day is also referred to as Black Tuesday because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% (Malaysia, Mexico and New Zealand), and three by more than 40% (Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

The degree to which the stock market crashes spread to the wider economy ( or "real economy" ) was directly related to the monetary policy each nation pursued in response. The central banks of the United States, West Germany and Japan provided market liquidity to prevent debt defaults among financial institutions, and the impact on the real economy was relatively limited and short-lived. However, refusal to loosen monetary policy by the Reserve Bank of New Zealand had sharply negative and relatively long-term consequences for both financial markets and the real economy in New Zealand.

The crash of 1987 also altered implied volatility patterns that arise in pricing financial options. Equity options traded in American markets did not show a volatility smile before the crash but began showing one afterward.

{snip}

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

4 replies, 1979 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (1)

ReplyReply to this post

4 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent. (Original Post)

mahatmakanejeeves

Oct 2022

OP

I was in my peak earning period, so I called my broker to "buy on the dip"

question everything

Oct 2022

#3

Exactly five days after I took out a mortgage loan at 10% interest for a new house.

Midnight Writer

Oct 2022

#4

Hugh_Lebowski

(33,643 posts)1. I remember it well, as it was my 21st birthday (nt)

mahatmakanejeeves

(60,933 posts)2. Oh, you kid. Happy birthday. NT

question everything

(48,797 posts)3. I was in my peak earning period, so I called my broker to "buy on the dip"

Midnight Writer

(22,971 posts)4. Exactly five days after I took out a mortgage loan at 10% interest for a new house.

Kind of freaked me out at the time, but I didn't have any money in the markets and things bounced back pretty quick.

My biggest worry was losing my job in a round of lay-offs.