Here's one for ya

Required disclaimer:

This is ONLY for those who enjoy managing their own portfolios and trying to outperform the market. There is no guarantee that any individual stock (or any fund, for that matter) will rise. Market timing can be risky and time-consuming, and the average investor should avoid any attempt at doing so.

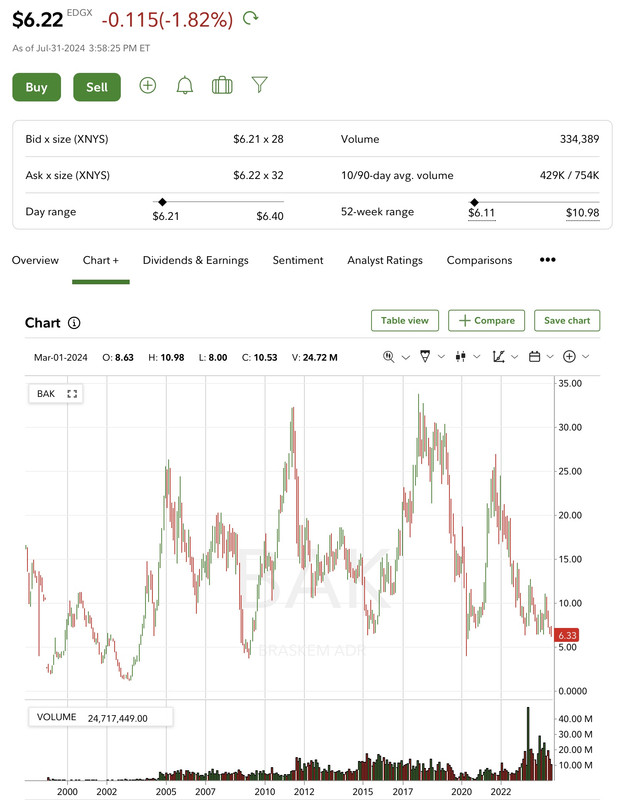

The stock in question has been trading since 1999: BAK (Braskem ADR)

Company profile:

Braskem S.A., together with its subsidiaries, produces and sells thermoplastic resins. The company produces and sells olefins, including ethylene, polymer and chemical grade propylene, butadiene, and butene-1; intermediates, such as cumene, paraxylene, ortho-xylene, and others; polyethylene (PE) and polypropylene (PP); polyvinyl chloride; hydrochloric acid, dichloroethane - EDC, and sodium hypochlorite; fuels, such as gasoline, boosters, and others; solvents, such as toluene, xylene, and other products; and specialties comprising polyisobutene, hydrocarbon resin, isoprene, dicyclopentadiene, piperylene, nonene, tetramer, green PE wax, and other products. It also supplies electricity and other inputs to second-generation producers; produces and sells caustic soda; produces and sells ethylene, high-density PE, and low-density PE in Mexico; manufactures, sells, imports, and exports chemicals, petrochemicals, and fuels; and produces, supplies, and sells utilities, such as steam, water, compressed air, and industrial gases. The company was formerly known as Copene Petroquimica do Nordeste S.A. and changed its name to Braskem S.A. in 2002. Braskem S.A. was founded in 1972 and is headquartered in Sao Paulo, Brazil. Braskem S.A. operates as a subsidiary of Novonor S.A.

www.braskem.com.br

Chart:

Source: Fidelity.com

It’s currently trading within the bottom 1% of its historical price, adjusted for inflation. It's my opinion that it is a very good buy right now.

In case the first warning didn’t stick: Past performance does not guarantee future performance, and I am not a financial advisor.

Good luck, fellow traders!

brush

(59,498 posts)I used to have a url for a site to look up graphs of any stock that showed their history of highs and lows.

Can you recommend one?

brush

(59,498 posts)A HERETIC I AM

(24,755 posts)It stands for “American Depository Receipts” which is a block of shares of a foreign based company held by a depository bank, usually a foreign branch of that bank, like the Singapore branch of Chase, for instance.

The bank buys a block of shares of a given firm on the overseas exchange and those shares are held in trust. Individual shares (or an ADS) of the underlying securities are then available on a US exchange. It’s important to remember that the price of a given ADS may not directly correlate to the price of the share on the offshore stock market, even considering currency exchange rates.

Investopedia has a good article on these instruments;

https://www.investopedia.com/terms/a/adr.asp