Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Environment & Energy

Related: About this forumIEA: Global Hydrogen Review 2024 - Executive summary

https://www.iea.org/reports/global-hydrogen-review-2024/executive-summaryGlobal Hydrogen Review 2024

Executive summary

More projects and more final investment decisions, but setbacks persist

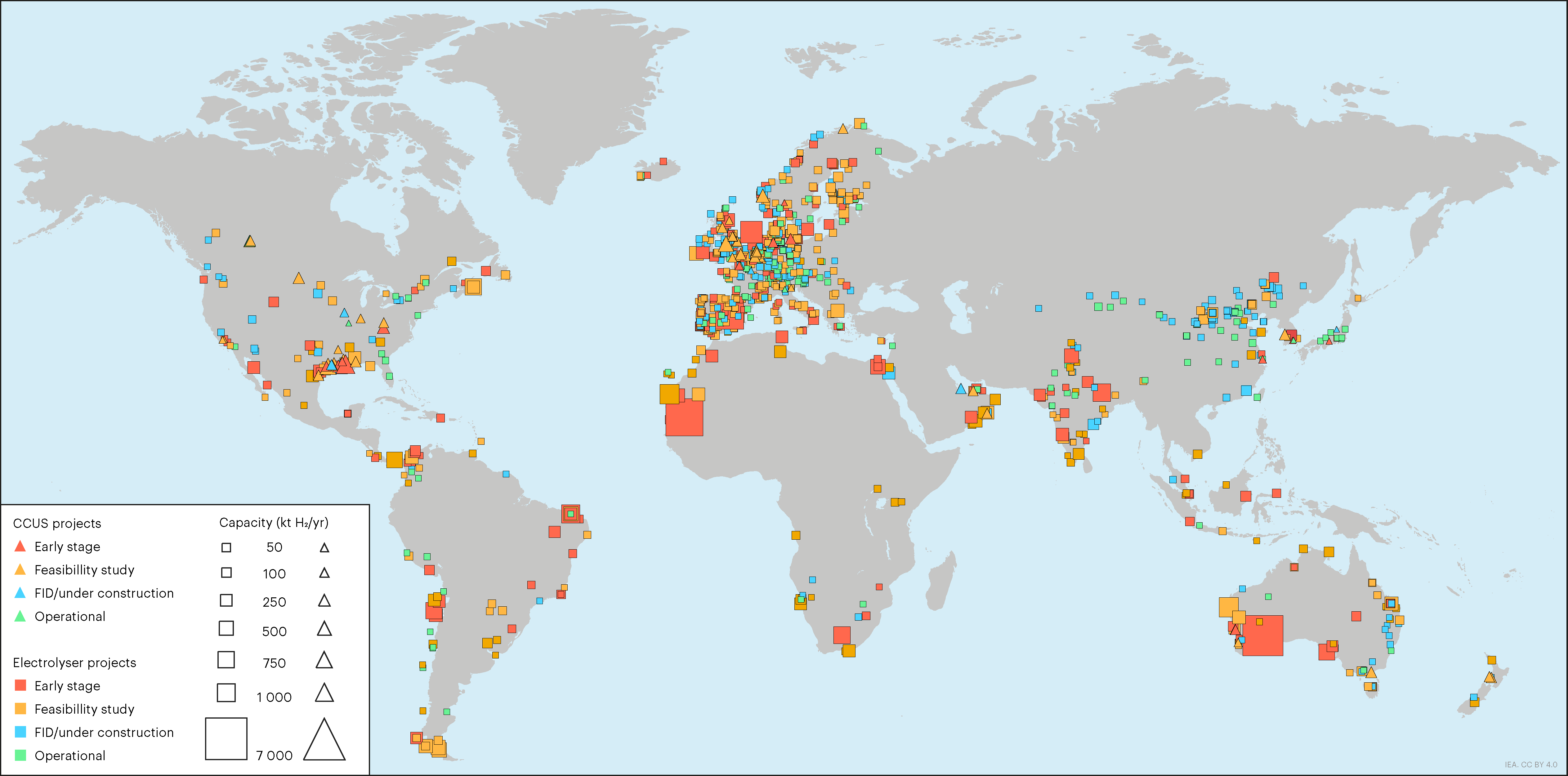

Global hydrogen demand reached 97 Mt in 2023, an increase of 2.5% compared to 2022. Demand remains concentrated in refining and the chemical sector, and is principally covered by hydrogen produced from unabated fossil fuels. As in previous years, low-emissions hydrogen played only a marginal role, with production of less than 1 Mt in 2023. However, low-emissions hydrogen production could reach 49 Mtpa by 2030 based on announced projects, almost 30% more than when the Global Hydrogen Review 2023 was released. This strong growth has been mostly driven by electrolysis projects, with announced electrolysis capacity amounting to almost 520 GW. The number of projects that have reached a final investment decision (FID) is also growing: Announced production that has taken FID doubled compared with last year to reach 3.4 Mtpa, representing a fivefold increase on today’s production by 2030. This is split roughly evenly between electrolysis (1.9 Mtpa) and fossil fuels with carbon capture, utilisation and storage (CCUS) (1.5 Mtpa).

Hydrogen production from fossil fuels with CCUS has gained ground over the past year – although the total potential production from announced projects grew only marginally compared with last year, there were several FIDs for previously announced large-scale projects, all of which are located in North America and Europe. As a result, the potential production in 2030 from projects using fossil fuels with CCUS that have taken FID more than doubled in the last year, from 0.6 Mtpa in September 2023 to 1.5 Mtpa today.

Overall, this is noteworthy progress for a nascent sector, but most of the potential production is still in planning or at even earlier stages. For the full project pipeline to materialise, the sector would need to grow at an unprecedented compound annual growth rate of over 90% from 2024 until 2030, well above the growth experienced by solar PV during its fastest expansion phases. Several projects have faced delays and cancellations, which are putting at risk a significant part of the project pipeline. The main reasons include unclear demand signals, financing hurdles, delays to incentives, regulatory uncertainties, licensing and permitting issues and operational challenges.

Source: IEA (2024), Hydrogen Production Projects Database, accessed on October 2024. Notes: CCUS = carbon capture, utilisation and storage; FID = final investment decision.

China and electrolysers – the sequel to solar PV and batteries?

Announced electrolyser capacity that has reached FID now stands at 20 GW globally, of which 6.5 GW reached FID over the last 12 months alone. China is strengthening its leadership, accounting for more than 40% of global FIDs in capacity terms over the same period. China’s front-running position is backed by its strength in the mass manufacturing of clean energy technologies: it is home to 60% of global electrolyser manufacturing capacity. China’s continued expansion of manufacturing capacity is expected to drive down electrolyser costs, as has occurred with solar PV and battery manufacturing in the past. Moreover, several large Chinese manufacturers of solar panels have entered the business of manufacturing electrolysers, and today they account for around one-third of China’s electrolyser manufacturing capacity. However, other regions are also stepping up efforts: in Europe, FIDs for electrolysis projects quadrupled over the last year to reach more than 2 GW, while India has emerged as one of the key players thanks to a single FID for 1.3 GW.

…

International Energy Agency | Global Hydrogen Review 2024 | Executive Summary

Subject to the IEA’s Notice for CC-licenced Content, this work is licenced under a Creative Commons Attribution 4.0 International licence.