American History

Related: About this forumOn October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent.

Last edited Tue Oct 29, 2024, 09:09 AM - Edit history (1)

I had just started a new job. The old timers saw a lot of money disappear that day. {ETA: on paper, as people noted. If they didn't have to sell right away, they came out okay.}

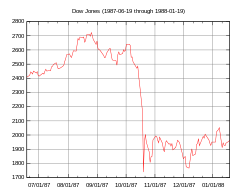

DJIA (June 19, 1987 to January 19, 1988)

Date: October 19, 1987

Type: Stock market crash

Outcome:

Dow Jones Industrial Average falls 508 points (22.6%), making it the largest one-day drop by percentage in the index's history.

Federal Reserve provides market liquidity to meet unprecedented demands for credit.

Dow Jones begins to recover in November 1987.

NYSE institutes rule regarding trading curbs in 1988.

FTSE 100 Index of the London Stock Exchange

(June 19, 1987 to January 19, 1988)

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on Monday, October 19, 1987. In Australia and New Zealand, the day is also referred to as Black Tuesday because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% (Malaysia, Mexico and New Zealand), and three by more than 40% (Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

The degree to which the stock market crashes spread to the wider economy ( or "real economy" ) was directly related to the monetary policy each nation pursued in response. The central banks of the United States, West Germany and Japan provided market liquidity to prevent debt defaults among financial institutions, and the impact on the real economy was relatively limited and short-lived. However, refusal to loosen monetary policy by the Reserve Bank of New Zealand had sharply negative and relatively long-term consequences for both financial markets and the real economy in New Zealand.

The crash of 1987 also altered implied volatility patterns that arise in pricing financial options. Equity options traded in American markets did not show a volatility smile before the crash but began showing one afterward.

{snip}

Tue Oct 15, 2024: On this day, October 15, 2008, the Dow Jones Industrial Average dropped 733 points.

Thu Oct 19, 2023: On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent.

Sun Oct 15, 2023: On this day, October 15, 2008, the DJIA dropped 733 points.

Wed Oct 19, 2022: On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent.

Sat Oct 15, 2022: On this day, October 15, 2008, the DJIA dropped 733 points.

Tue Oct 19, 2021: On this day, October 19, 1987, Black Monday, the Dow Jones Industrial Average fell by 22.6 percent

Thu Oct 15, 2020: On October 19, 1987, Black Monday happened.

bucolic_frolic

(48,220 posts)Part 1 - Before the Crash - Wall Street Week October 16, 1987

Part 2 - Before the Crash - Wall Street Week October 16, 1987

mahatmakanejeeves

(62,374 posts)Thank you, and good morning.

bucolic_frolic

(48,220 posts)mahatmakanejeeves

(62,374 posts)It's basically a vanity project. I post things that are of interest to me. I see the posts as a diversion from ... the rest of the world.

Some of the things I bring up really are important. Others, less so. The rule is whatever strikes my fancy.

Not everything is pleasant -- school shootings, hotel fires, midair collisions -- but it happened, and I feel it should be noted.

Thanks for reading my posts. And good afternoon.

JT45242

(3,072 posts)A lot of friends were panicked.

"My parents list my whole college fund yesterday"

My reply was "did they sell yesterday? If they didn't sell they didn't lose anything. The stock market always bounces back as long as they don't sell low you'll be fine. "

These were smart kids (honors track, national merit finalists) and they didn't understand that the losses only occur if you sell. Otherwise it is just noise. As I recall the bounce back only took about 12 months.

marybourg

(13,255 posts)stock at the bargain price, you did very well and learned a valuable lesson.

mahatmakanejeeves

(62,374 posts)I just found these as replies in the thread for 2021. Some are duplicates of what's already been posted. Enjoy.

From Tomconroy:

Tue Oct 19, 2021: My all time favorite Louis Rukeyser moment (his first minute):

From me:

Tue Oct 19, 2021: I miss that show.

Here's Wall $treet Week with Louis Rukeyser from the Friday before Black Monday. Marty Zweig was as downbeat as I'd ever seen him. The gloom begins at 6:45 in the first video.

198,246 views Jul 13, 2008

crashof1987

904 subscribers

First 10 minutes of Wall Street Week episode from Friday October 16, 1987 just prior to the market crash on black Monday. Hosted by Louis Rukeyser, guests included Martin Zweig, Marry Farrell, Louis Holland and Allen Sinai.

32,316 views Jul 13, 2008

crashof1987

904 subscribers

Second 10 minutes of Wall Street Week episode from Friday October 16, 1987 just prior to the market crash on black Monday. Hosted by Louis Rukeyser, guests included Martin Zweig, Marry Farrell, Louis Holland and Allen Sinai.

Here it is, all at once.

4,108 views Oct 12, 2019

Investors Journal

12.1K subscribers

First 10 minutes of Wall Street Week episode from Friday October 16, 1987 just prior to the market crash on black Monday. Hosted by Louis Rukeyser, guests included Martin Zweig, Marry Farrell, Louis Holland and Allen Sinai.

{snip}

Mutual fund manager

Zweig appeared regularly on PBS television's Wall $treet Week with Louis Rukeyser, and in 1992 he was voted into the program's Hall of Fame. It was on that very program that he stated on 16 October 1987, that he was deeply worried and did not like what he saw in the stock market. The 1987 stock market crash occurred on 19 October 1987. At the time of his death Zweig was the chairman of Zweig-DiMenna Associates, Inc. He is also featured in John Reese's recent book, The Guru Investor: How to Beat the Market Using History's Best Investment Strategies.

{snip}