Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Personal Finance and Investing

In reply to the discussion: I am retired and 73 years old, where can you park [View all]drray23

(7,962 posts)6. thats why you have to work with advisors and financial managers.

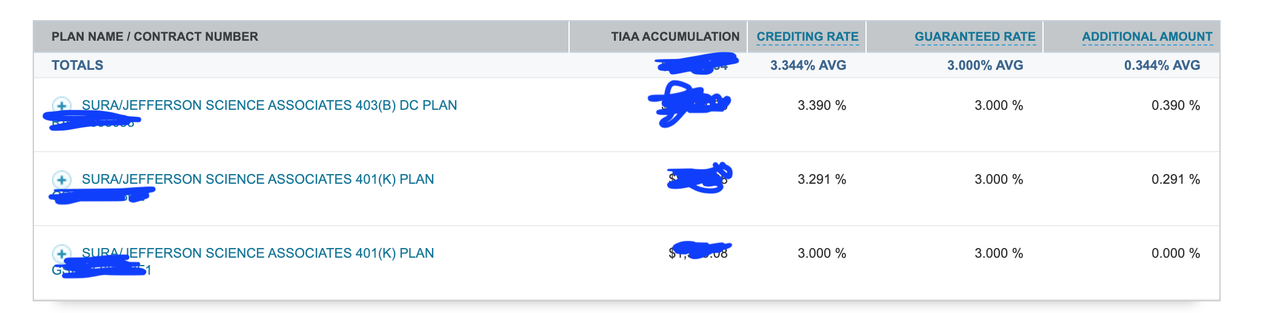

There is a lot more out there than just CDs but many of these are accessible only via financial brokerage firms. Here is a subset of some of my accounts. I grayed out the account #s and $ for privacy. Look at the guaranteed returns.

Those are financial instruments (annuities) managed by the financial firm where my money is parked. Basically they guarantee to pay out 3 % and some years if it goes well you get more (like right now, you can see two of those accounts have additional yields)

Edit history

Please sign in to view edit histories.

45 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

I posted before I was finished, please read it again, I made a serious reply.

marble falls

May 2021

#23

It appears you have a misunderstanding of what TIAA does and what an Annuity is.

A HERETIC I AM

May 2021

#37

I put a group named Blooom in control of my 401(k), which is with another company.

NBachers

May 2021

#4

Remember the old days when they'd roll them over if you didn't cash them in?

marble falls

May 2021

#25

Odd the EE savings bonds suck so much (these are the ones without the inflation adjust)

progree

May 2021

#27

Some may compare annuity yields to those of bonds and CD's without understanding the differences

progree

Jun 2021

#40

My annuities will not die with me, if there is still any value left.

PoindexterOglethorpe

Jun 2021

#41

I'm guessing interest rates and annuity yields were considerably higher when you bought

progree

Jun 2021

#42

I haven't seen anything like 4% - 5% anywhere for a long long time, and municipal bonds are not a

progree

May 2021

#28

Can new investors buy these, e.g. the EVM Eaton Vance California Municipal Bond Fund

progree

May 2021

#31